Comprehensive Guide to Intraday Trading: Strategies, Tips, and Stocks Screener

Pavan

28th Nov 2023

Introduction to Intraday Trading

Intraday trading or day trading will involve the buying and selling of financial assets such as stocks known as equity, and derivatives instruments such as futures and options within the same trading day.

Many Traders aim to make a profit from short-term price movements of such assets as stocks, derivatives ( futures and options ), currencies, or commodities.

Intraday trading strategy demands very quick decision-making, analyzing charts including candlestick patterns, and leveraging stock market volatility for reasonable gains.

Promising quick profits requires high skill sets, discipline, experience, and a well-developed risk management system. As Much as 95 per cent of day traders are losing money in intraday trading and this is happening because of many factors including lack of knowledge, analysis tools, broker system failures and very low quality of broker trading infrastructure.

No one cares about retail traders including Stock Market regulators like SEBI when it comes to penalized brokers for system failures, delayed data feeds, outdated infrastructure, education, and more.

Don’t worry we will cover all these topics, tools and more related guides on intraday trading in the coming days. So stay tuned.

Why many traders fail in Stock Market or Intraday Trading

Many traders fail because of a lack of patience and discipline. Let’s take an example, before we even start understanding how stock screeners work or understanding different intraday stock screeners, many have already skipped or scrolled to the last part of this article.

It’s very difficult to survive in the stock market for more than 2 years and for your information, 70 per cent of the traders quit in the first 9 months of their trading career.

Intraday Trading Strategies and Tips for Success

To be successful in the stock market or intraday trading, you don’t need any fancy strategies or tools at all but you need those strategies or tools later in your trading journey once you survive at least for more than 3 years.

At the beginning of your intraday trading journey, you need to understand and learn the basics of the stock market, which means you need to focus on the following topics first and believe me – it will work for you.

Do’s and Don’ts of Day Trading and Trading Rules

- Technical Analysis

- Fundamental Analysis

- Momentum Trading

- Breakout Trading

- Range-bound Trading

- Risk Management Strategies

- Positional Hedging

- Risk Factors and More

- Candlestick patterns

We will cover these topics in the coming days. Till that time you can start learning these topics online anytime. But do make sure to avoid the following mistakes to avoid being a failure in intraday trading.

- Don’t do Scalping at the beginning of your trading journey at least for 1 year.

- Don’t trade before you understand the range-bound market or trading

- Overtrading will become a disaster

- Before placing a stop loss, don’t dare to take any intraday positions

- Avoiding taking Emotional Decision while doing trading or even investing

- Don’t convert your positions from intraday to positional trade

Do Save this post and revisit us whenever you think of intraday trading or feeling alone in the stock market. We are here to help you.

Identifying Top Intraday Stocks and Tools

If you understand the topics which we already covered in this post then you will already be able to screen stock independently on your own but since everyone needs a little help to get started with their career, we are here to help you with identifying top intraday stocks.

Stock market is a highly skill-based career option, which you have already chosen to do. So here we cover one of the methods to help you screen stocks for intraday trading.

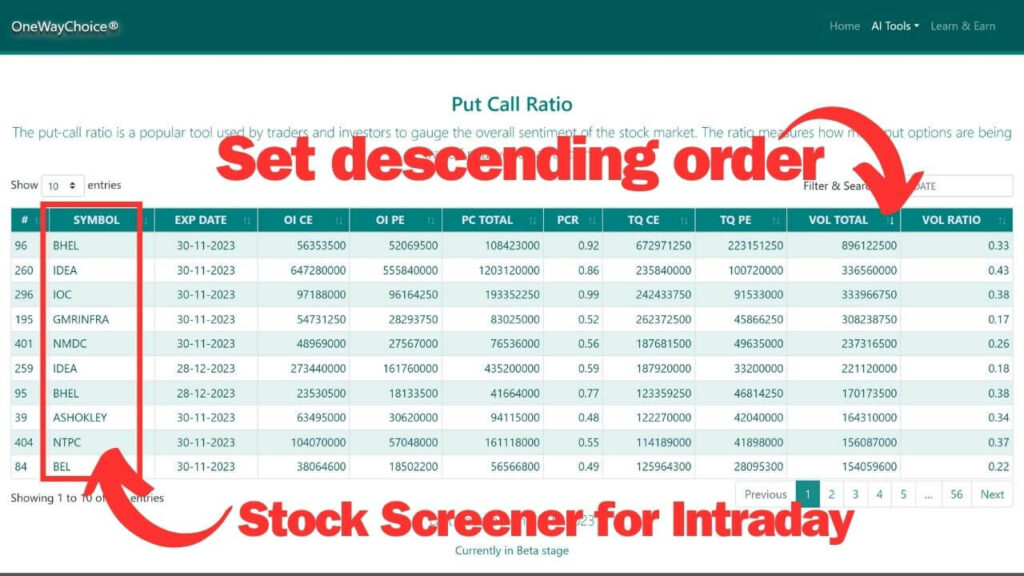

Put Call Ratio (PCR) Analysis: Assessing Market Sentiment via Options Trading – Stock Screener for Intraday Trading

If we start finding the best stocks for intraday trading then there are many methods to scan or screen stocks for intraday and we will cover one of those today, which is based on Put Call Ratio Analysis, and well-known as PCR Analysis.

The Put Call Ratio analysis known as PCR analysis is a pivotal metric in options trading, which will be calculated by dividing the total volume of outstanding put options by the total volume of outstanding call options on a specific underlying asset such as stocks or index.

A high PCR – PCR-put call Ratio implies a bearish market sentiment, indicating more puts traded relative to calls. Conversely, a low PCR – Put Call Ratio suggests a bullish market sentiment, signalling higher call volume compared to put volume.

Traders view extreme PCR levels as potential contrarian indicators. A significantly high PCR might indicate an oversold market, potentially forecasting a reversal. Conversely, an extremely low PCR may signal an overbought market, potentially hinting at a forthcoming correction.

PCR Analysis or Put Call Ratio Analysis aids traders in understanding prevailing market sentiment or stock sentiment based on options activity, offering very good insights into potential market directions or reversals.

It’s a must and should to do PCR analysis with other technical or fundamental indicators for comprehensive market assessment.

It is highly rewarding to use a PCR analysis tool to screen stocks for intraday trading since it has a high potential to give overall market or stock sentiment and the volume of trades that are taking place in the stock.

We can filter out the stocks by filtering out high-volume stocks that are traded and can see a PCR ratio to gauge the next movement or trend of the stocks.

In the Navigation tab, you can find the PCR Analysis tool.

Conclusion: Mastering the Art of Intraday Trading

It doesn’t matter whether you are trading in stocks, stock futures, or stock options. If you use this PCR screener for intraday stock screening then you can do intraday trading in any of the instruments available in the market based on your skills and interest.

Make sure you try an analysis PCR tool for stock screening at least for 21 days then you are never going to look back on your trading journey.

We will discuss more screeners and topics in upcoming posts so stay tuned here for updates.

All the best for your Stock Market Career.