Comprehensive Guide to Intraday Trading: Gann Calculator

Pavan

1st Dec 2023

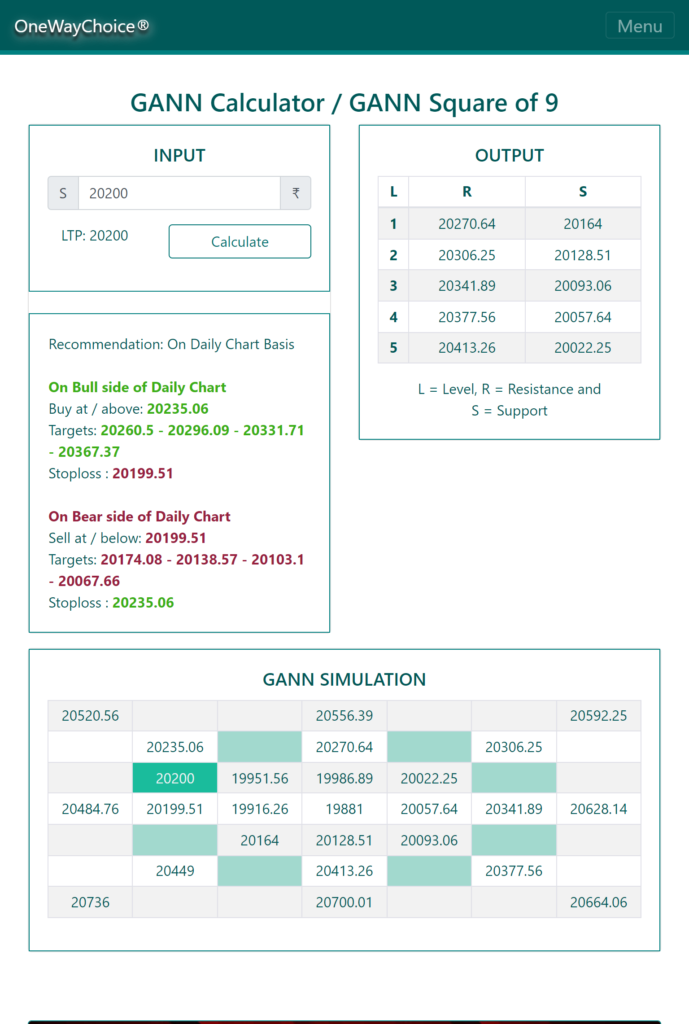

One Way Choice tries to develop a fully well-trained AI model on the Gann Calculator, Which considers the following key points W. D. Gann Theory to enhance accuracy while predicting price and forecasting price movements, Identification of Support and Resistance, Stock Price Trend Analysis and also, Time and Price Relationship. Let’s understand Gann’s Theory and the basis of using it in detail.

Among many tools, the Gann calculator or Square of 9 stands out as a sophisticated yet invaluable instrument, empowering intraday traders and positional traders with precise calculations and forecasting capabilities also used for drawing support and resistance.

In the dominion of financial markets particularly the Stock Market, traders and analysts constantly seek new analysis tools that offer insightful perspectives of the market outlook for making informed decisions.

Let’s dive into the depths of the W D Gann calculator, exploring its overwhelming functionalities and trying its best to solve queries associated with it.

Understanding the Gann Calculator

The Gann calculator or Gann Square of 9 derives its name from the legendary analyst and trader W.D. Gann, known for his pioneering work in technical analysis in both the Commodity Market, Stock Market and overall Financial Markets.

This tool is designed and developed to facilitate complex stock market calculations based on Gann’s theories which primarily focus on geometric price-time relationships, angles and squares in the stock markets and overall in all financial instruments.

Finalized Queries Explained on Gann Calculator:

1. It serves as a tool utilized in financial analysis to compute potential support and resistance levels. Its methodology revolves around the square root principles of numbers, aiding in the assessment of probable price levels.

2. This tool encompasses a wide range of tools and mathematical formulas attributed to W.D. Gann’s trading methodologies. These tools play a pivotal role in market analysis, enabling traders to forecast trends and make informed decisions.

3. This tool specifically refers to calculators or tools directly aligned with the trading methodologies and fundamental principles advocated by W.D. Gann.

4. The Gann calculator formula involves the application of mathematical formulas and algorithms within the Gann calculator. These formulas are instrumental in conducting predictive analysis in financial markets.

5. The Gann angle calculator, an integral feature of the Gann calculator, is utilized for plotting trend lines and assessing the angle of price movements in financial instruments.

6. The Gann square calculator primarily focuses on executing square calculations and exploring geometric relationships as proposed by Gann’s theoretical frameworks.

Leveraging Gann Calculators for Trading Success

1. Price Prediction and Forecasting: This tool serves as a valuable aid for traders seeking to predict future price movements. They achieve this by meticulously analyzing historical data, employing mathematical models, and leveraging geometric principles to extrapolate potential market directions.

2. Support and Resistance Identification: Play a pivotal role in identifying critical support and resistance levels. These tools empower traders by providing key insights into probable price zones, thereby assisting in strategic decision-making processes.

3. Trend Analysis: Utilizing Gann angles and geometric interpretations, traders can conduct in-depth analyses of market trends. This approach enables them to assess the robustness of trends and their trajectories, contributing to more precise predictions of future market movements.

4. Time and Price Relationship: Gann’s theory emphasizes the intrinsic relationship between time and price movements within financial markets. By understanding this correlation, traders gain valuable insights into potential reversal points or the continuation of prevailing trends, aiding them in making informed trading decisions.

Conclusion:

The Gann calculator / Gann Square of 9 Calculator remains a diamond stone for traders, offering a unique yet very accurate perspective on market movements and providing a structured approach while studying technical analysis in intraday trading or positional trading.

Understanding and utilizing Gann Theory’s various tools and formulas, intraday or positional traders can enhance their decision-making processes and potentially unlock new avenues for profitable trades.

Remember, while it is a powerful tool, combining this with sound trading strategies and risk management practices is crucial for a successful trading career.

Special Thanks to W.D. Gann and OneWayChoice.com

We have developed a more advanced Put Call Ratio analysis tool that provides all necessary stock screening data based on the put call ratio in a single tab and you can use many filters provided in the Put Call Ratio Stock Screener tool for Intrading trading or positional trading here.